unemployment insurance tax refund 2021

To combat and stop unemployment insurance UI. The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American.

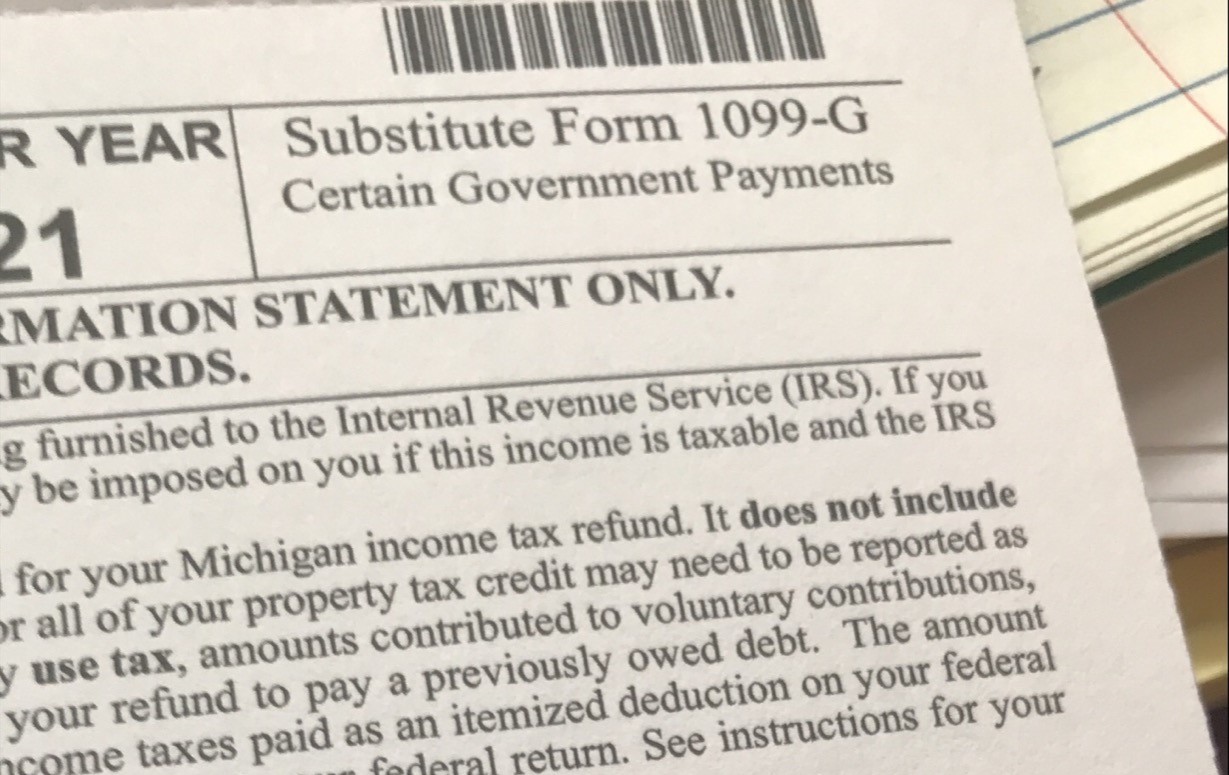

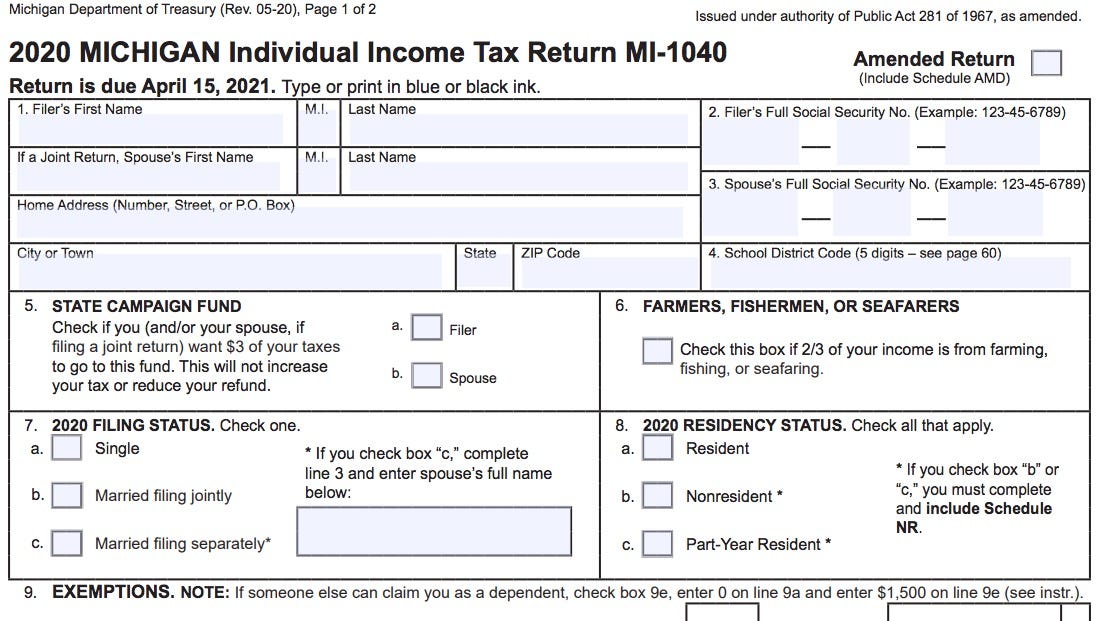

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

The return includes a claim for the Earned Income Tax Credit or Additional Child Tax Credit.

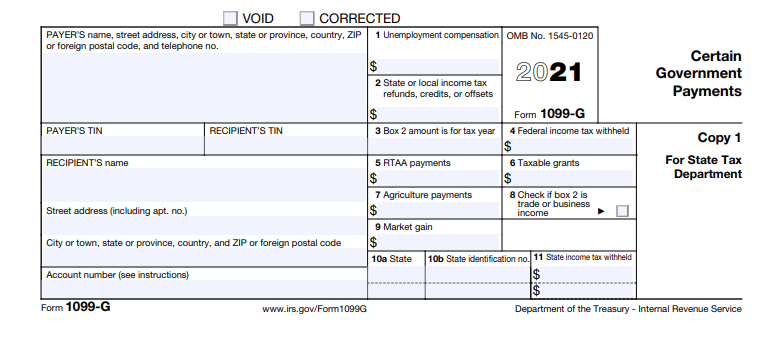

. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment. For additional information pertaining to the electronic filing regulation and requirements contact the Employer account Service unit at 866 4299757. It sent 1400 stimulus checks into Americans bank accounts it enhanced the Child Tax Credit and it boosted unemployment benefits for a large chunk of 2021.

Use the Unemployment Tax and Wage System TWS to. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. File a Quarterly Wage Report.

File Wage Reports Pay Your Unemployment Taxes Online. State law instructs ESD to adjust the flat social tax rate based on the employers rate class. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account.

File a Report of Change. View Benefit Charge and Rate Notices. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes.

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American. For tax years beginning before January 1 2016 if the preceding years tax was more than 1000 the taxpayer or combined group as applicable must pay an amount equal to 25 of this tax at. The DocuSign email will provide information about accessing the 2022 1099-G tax form which will become available in January 2023.

New employers subject to Unemployment Insurance taxes must register with NMDWS on to the Unemployment Insurance Tax Self-Service System. Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the.

Submitting this form will. After registering with NMDWS you will. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and.

The tools tracker displays progress through three phases. UI Tax Payment by ACH Debit.

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

Stimulus Check Updates News On Irs Tax Refunds Child Tax Credit California Stimulus Unemployment Benefits Lee Daily

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Accessing Your 1099 G Sc Department Of Employment And Workforce

430 000 People To Receive Surprise Tax Refund From Irs

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Unemployment 10 200 Tax Break Some States Require Amended Returns

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Unemployed In 2020 Get Ready For A Big Tax Refund

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Dwd Will Collect Unemployment Overpayments From Tax Refunds

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com